Delving into the realm of service providers, the necessity of liability insurance becomes glaringly clear. From protecting against unforeseen circumstances to ensuring financial security, this insurance plays a vital role in the sustainability of service-based businesses. Let’s explore why liability insurance is an indispensable asset for service providers.

Importance of Liability Insurance

Liability insurance is a crucial aspect for service providers as it offers protection against potential risks and uncertainties that may arise during the course of providing services to clients. Without liability insurance, service providers are exposed to various financial and legal threats that could significantly impact their business and personal assets.

Examples of Situations where Liability Insurance Can Protect Service Providers

- Professional Errors: In the event of a mistake or error in the services provided, liability insurance can cover legal fees, settlements, or damages that may result from the error.

- Accidents or Injuries: If a client or third party sustains an injury or property damage due to the service provider’s actions, liability insurance can cover the costs associated with medical bills, repairs, or legal claims.

- Negligence Claims: If a client alleges negligence or misconduct on the part of the service provider, liability insurance can provide financial protection and support in defending against such claims.

Potential Risks Service Providers Face Without Liability Insurance

- Financial Loss: Without liability insurance, service providers may have to bear the full cost of legal fees, settlements, or damages resulting from lawsuits or claims, leading to significant financial strain.

- Reputation Damage: Legal disputes or claims against a service provider can tarnish their reputation and credibility in the industry, impacting their ability to attract new clients and retain existing ones.

- Business Closure: In extreme cases, the financial burden of legal liabilities without insurance coverage could force a service provider to shut down their business, leading to loss of livelihood and assets.

Types of Liability Insurance

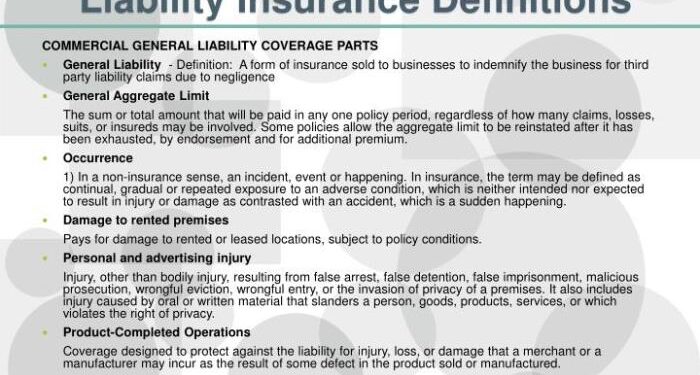

When it comes to protecting service providers from potential risks, there are different types of liability insurance available. Two common options are general liability insurance and professional liability insurance, each catering to specific needs.

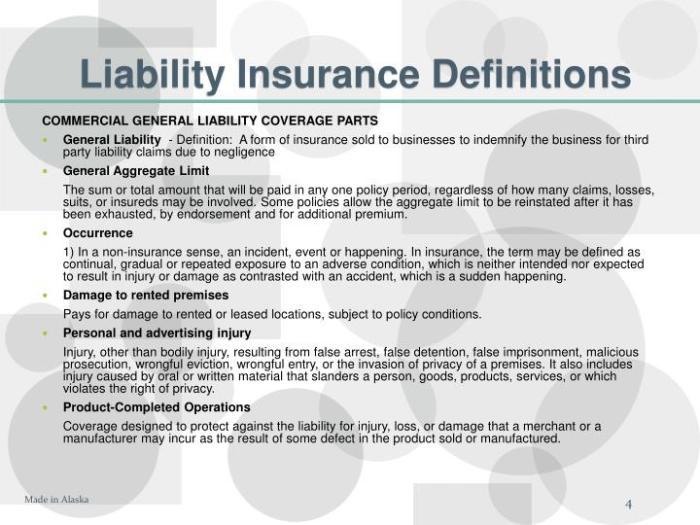

General Liability Insurance

General liability insurance provides coverage for claims of bodily injury, property damage, and advertising injury. It protects service providers in case a client or third party suffers an injury or property damage as a result of the service provided.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, is designed to protect service providers from claims of negligence, errors, or omissions in their professional services. This type of insurance is crucial for professions that involve providing advice or services based on expertise.

Legal Requirements and Compliance

Service providers are often required by law to have liability insurance in place to protect themselves, their clients, and the general public.

Legal Requirements for Service Providers

Service providers must comply with specific regulations that mandate the type and amount of liability insurance they need to carry. These requirements vary depending on the industry, location, and the nature of services provided.

- For example, healthcare professionals such as doctors and nurses are typically required to have malpractice insurance to cover claims related to medical errors.

- Contractors and construction workers may need general liability insurance to protect against property damage or bodily injury claims on job sites.

Benefits of Compliance with Liability Insurance Regulations

Complying with liability insurance regulations can benefit service providers in several ways:

-

Legal Protection:

Having the required insurance coverage can protect service providers from lawsuits and legal claims that could otherwise result in financial ruin.

-

Professionalism:

Demonstrating compliance with regulations can enhance the reputation of service providers and instill confidence in clients and customers.

-

Peace of Mind:

Knowing that they are adequately covered by insurance can give service providers peace of mind and allow them to focus on their work without constant worry.

Consequences of Non-Compliance

Failure to meet legal requirements for liability insurance can have serious consequences for service providers:

-

Legal Penalties:

Service providers may face fines, license suspension, or even legal action for operating without the necessary insurance coverage.

-

Financial Risks:

Without liability insurance, service providers are personally liable for any claims or damages, putting their assets and livelihood at risk.

-

Loss of Trust:

Non-compliance can damage the reputation of service providers and lead to a loss of trust among clients, resulting in a loss of business opportunities.

Cost-Benefit Analysis

When it comes to service providers, investing in liability insurance may seem like an additional expense. However, a closer look at the cost-benefit analysis reveals that the benefits of having liability insurance far outweigh the costs in the long run.

Financial Implications of Not Having Liability Insurance

Not having liability insurance can have severe financial implications for service providers. Here is a detailed breakdown of the potential consequences:

- Legal Costs: Without liability insurance, service providers may have to bear the full brunt of legal expenses in case of a lawsuit. This includes attorney fees, court costs, and settlements, which can quickly add up to substantial amounts.

- Damage Compensation: In the absence of liability insurance, service providers may have to pay for damages out of pocket. This can range from property damage to bodily injury claims, leading to significant financial strain.

- Reputation Damage: A lawsuit or claim against a service provider can tarnish their reputation in the industry. This can result in loss of clients, negative reviews, and ultimately, a decline in business revenue.

- Business Continuity: Without liability insurance, a service provider may face challenges in sustaining their operations. Financial setbacks from lawsuits or claims can jeopardize the continuity of the business.

Final Wrap-Up

In conclusion, the significance of liability insurance for service providers cannot be overstated. It serves as a shield against potential risks, legal requirements, and financial implications that could otherwise jeopardize the existence of a service-based business. By investing in liability insurance, service providers not only protect their assets but also secure their future endeavors.

FAQs

What are the consequences of not having liability insurance as a service provider?

Without liability insurance, service providers are at risk of facing hefty legal fees, compensation claims, and potential bankruptcy in case of lawsuits or accidents. It leaves them vulnerable to financial ruin and tarnished reputations.

Is liability insurance mandatory for all service providers?

While it may not be a legal requirement in all jurisdictions, having liability insurance is highly recommended to protect service providers from unexpected liabilities and risks that could arise during the course of business operations.

How does general liability insurance differ from professional liability insurance?

General liability insurance covers claims of bodily injury, property damage, and advertising injury, whereas professional liability insurance protects against claims of negligence or errors and omissions in service provision. Each caters to different aspects of a service provider’s business.