Exploring the realm of life insurance policy quotes opens up a world of crucial information and decision-making. Dive into this guide with a blend of expertise and originality, ensuring a captivating reading journey ahead.

Delve into the specifics of what to anticipate when seeking out a life insurance policy quote.

Understanding Life Insurance Policy Quote

When considering purchasing a life insurance policy, it is essential to understand the purpose of a life insurance policy quote. A life insurance policy quote provides you with an estimate of the cost and coverage options available to you based on your personal information and needs.

Purpose of a Life Insurance Policy Quote

A life insurance policy quote is designed to give you an idea of the premiums you would pay and the coverage you would receive from different insurance providers. It helps you compare options and make an informed decision about which policy best suits your financial goals and protection needs.

Information Included in a Life Insurance Policy Quote

- Estimated premium amount

- Type of coverage (such as term life or whole life)

- Death benefit amount

- Policy terms and conditions

- Additional riders or benefits

Significance of Obtaining Multiple Quotes

It is crucial to obtain multiple life insurance policy quotes before deciding on a policy. By comparing quotes from different insurance companies, you can ensure that you are getting the best coverage at the most competitive price. This allows you to explore various options and tailor the policy to meet your specific needs and budget.

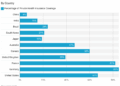

Factors Influencing Life Insurance Policy Quotes

When getting a life insurance policy quote, several key factors come into play that ultimately influence the cost of the policy. These factors include personal health, lifestyle choices, age, and coverage amount. Let’s delve into how each of these aspects impacts the life insurance policy quote.

Personal Health and Lifestyle Choices

Maintaining good health and making positive lifestyle choices can significantly impact the cost of your life insurance policy. Insurance companies typically assess your overall health, including factors such as BMI, blood pressure, cholesterol levels, and any pre-existing medical conditions. Individuals who lead a healthy lifestyle, such as non-smokers, regular exercisers, and those with no chronic health issues, often receive lower insurance quotes compared to individuals with health risks.

Age and Coverage Amount

Age is another crucial factor that influences life insurance policy quotes. Younger individuals tend to receive lower quotes as they are considered lower risk by insurance companies. As you age, the risk of developing health issues increases, leading to higher insurance premiums.

Additionally, the coverage amount you choose plays a significant role in determining the cost of the policy. Opting for a higher coverage amount will naturally result in a higher premium, as the insurance company is taking on a greater financial risk to provide the specified coverage.

Types of Life Insurance Policies

Life insurance policies come in various types, each offering different benefits and features tailored to meet the needs of policyholders. Two common types are term life insurance and whole life insurance policies.

Term Life Insurance vs. Whole Life Insurance

- Term Life Insurance:

- Provides coverage for a specific period, such as 10, 20, or 30 years.

- Offers a death benefit if the policyholder passes away during the term.

- Usually more affordable than whole life insurance.

- Whole Life Insurance:

- Provides coverage for the entire life of the policyholder.

- Includes a cash value component that grows over time.

- Offers both a death benefit and a savings component.

Impact of Policy Type on Quote

The type of life insurance policy chosen can significantly affect the insurance quote provided to the policyholder. Term life insurance policies generally have lower premiums compared to whole life insurance policies due to their temporary nature and focus solely on providing a death benefit.

On the other hand, whole life insurance policies have higher premiums because they offer lifelong coverage and include a cash value component that accumulates over time.

Differences in Premiums

- Term Life Insurance:

- Lower premiums due to the temporary coverage.

- Premiums can increase when the policy is renewed after the initial term expires.

- Whole Life Insurance:

- Higher premiums due to lifelong coverage and cash value component.

- Premiums remain level throughout the life of the policy.

Obtaining and Comparing Quotes

When it comes to shopping for a life insurance policy, obtaining and comparing quotes is a crucial step in finding the right coverage for your needs. By comparing quotes from multiple insurance providers, you can ensure that you are getting the best value for your money and the most suitable coverage for your circumstances.

Tips for Effectively Shopping for Life Insurance Policy Quotes

- Start by determining the type and amount of coverage you need based on your financial obligations and future goals.

- Request quotes from at least three different insurance providers to compare rates and coverage options.

- Consider working with an independent insurance agent who can provide quotes from multiple companies to help you make an informed decision.

- Review the details of each quote carefully, including premiums, coverage limits, exclusions, and any additional benefits or riders offered.

- Take note of any discounts or incentives that may be available to help lower the cost of your policy.

Importance of Comparing Quotes from Multiple Insurance Providers

- Comparing quotes from multiple insurance providers allows you to see the range of options available to you and make an informed decision.

- By comparing quotes, you can ensure that you are not overpaying for coverage and that you are getting the best value for your money.

- Different insurance providers may offer varying rates and coverage options, so comparing quotes can help you find the policy that best meets your needs.

How to Evaluate and Compare the Details of Different Policy Quotes

- Look at the premium amounts and payment frequency to determine the overall cost of the policy.

- Compare coverage limits and exclusions to ensure that you are getting the level of protection you need.

- Consider any additional benefits or riders offered by each policy and determine if they align with your needs and priorities.

- Check for any restrictions or limitations that may affect your ability to make a claim in the future.

- Take into account the financial strength and reputation of the insurance provider to ensure they will be able to fulfill their obligations in the event of a claim.

Coverage Options and Riders

When it comes to life insurance policies, there are various coverage options available to customize your plan according to your needs. Additionally, riders can be added to enhance your coverage by providing additional benefits or features.

Common Coverage Options

- Term Life Insurance: Provides coverage for a specific period of time.

- Whole Life Insurance: Offers coverage for your entire life and includes a cash value component.

- Universal Life Insurance: Combines a death benefit with a savings component that earns interest.

- Variable Life Insurance: Allows you to invest the cash value portion in various investment options.

What Are Riders and How They Impact Coverage

Riders are add-ons to a life insurance policy that provide extra benefits or features beyond the standard coverage. These riders can include options such as accelerated death benefit, accidental death benefit, waiver of premium, and long-term care riders. Adding riders can enhance the overall coverage of your policy by tailoring it to your specific needs.

Impact on Cost of Life Insurance Policy Quote

Adding riders to your life insurance policy can impact the overall cost by increasing the premium you pay. Each rider comes with an additional cost, so it’s essential to weigh the benefits of the rider against the extra expense.

Epilogue

In conclusion, navigating the landscape of life insurance policy quotes demands thorough understanding and careful consideration. This guide encapsulates the essence of what to expect, empowering you to make informed choices for your financial future.

FAQ Corner

What factors can influence the cost of a life insurance policy quote?

Factors such as age, health, lifestyle choices, and coverage amount can significantly impact the cost of a life insurance policy quote.

How can I effectively shop for life insurance policy quotes?

To shop effectively, compare quotes from multiple providers, consider different types of policies, and evaluate the details of each quote carefully.

What are riders in a life insurance policy, and how do they affect coverage?

Riders are additional provisions that can enhance coverage by adding specific benefits to a policy. They can impact the overall cost of the policy depending on the type of rider chosen.