Delving into the realm of Life and Critical Illness Cover unveils a world of crucial financial protection and security. This comprehensive guide aims to shed light on the nuances of these insurance options, offering a rich understanding that is both enlightening and practical.

Exploring the intricacies of life insurance and critical illness cover, we aim to equip readers with valuable insights to make informed decisions about their insurance needs.

Introduction to Life and Critical Illness Cover

Life insurance and critical illness cover are types of insurance policies designed to provide financial protection to individuals and their families in case of unexpected events. Life insurance offers a lump sum payment to beneficiaries upon the policyholder’s death, helping to cover expenses and provide financial stability during a difficult time.

On the other hand, critical illness cover provides a payout if the policyholder is diagnosed with a serious illness listed in the policy, such as cancer, heart attack, or stroke.Having these types of insurance is crucial to ensure that loved ones are taken care of financially in the event of death or critical illness.

It can help cover medical expenses, mortgage payments, debts, and other financial obligations, reducing the financial burden on the family during a challenging time.

Differences between Life Insurance and Critical Illness Cover

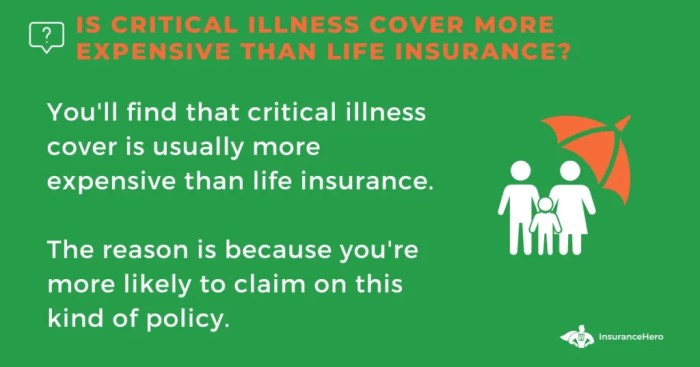

Life insurance focuses on providing a financial cushion to beneficiaries after the policyholder’s death, offering peace of mind and security to loved ones left behind. In contrast, critical illness cover is activated upon diagnosis of a serious illness, providing a lump sum payout to the policyholder to cover medical expenses and other costs associated with the illness.While life insurance primarily addresses the financial impact of death, critical illness cover aims to alleviate the financial strain caused by a serious illness, allowing the policyholder to focus on recovery without worrying about the financial consequences.Overall, both life insurance and critical illness cover play a vital role in safeguarding families and individuals against unforeseen circumstances, ensuring financial stability and peace of mind during challenging times.

Benefits of Life Insurance

Life insurance offers valuable financial protection for loved ones in the event of the policyholder’s death. It provides peace of mind knowing that dependents will be taken care of financially.

Coverage for Outstanding Debts and Funeral Expenses

Life insurance can help cover any outstanding debts, such as mortgages, loans, or credit card balances, ensuring that loved ones are not burdened with financial obligations after the policyholder passes away. Additionally, it can cover the costs associated with funeral expenses, relieving the family of the financial strain during a difficult time.

Tax Benefits

Life insurance payouts are typically tax-free for beneficiaries, providing an additional financial advantage. This means that the beneficiaries receive the full benefit amount without having to pay taxes on it. It helps ensure that the funds are available to support the family without any tax deductions.

Benefits of Critical Illness Cover

Critical illness cover is a type of insurance that provides financial support in the event of a serious illness. It offers a lump sum payment to the policyholder upon diagnosis of a covered critical illness, helping to alleviate the financial burden during a challenging time.

Types of Illnesses Covered

Critical illness policies typically cover a range of serious illnesses such as cancer, heart attack, stroke, organ transplant, and paralysis. These policies Artikel specific conditions that qualify for coverage, ensuring clarity for policyholders.

Importance of Critical Illness Cover

Critical illness cover is essential in complementing health insurance as it provides additional financial protection for unforeseen medical emergencies. While health insurance covers medical expenses, critical illness cover offers a lump sum payout that can be used for various purposes such as covering treatment costs, household bills, or even lifestyle adjustments during recovery.

Factors to Consider When Choosing Coverage

When selecting life and critical illness cover, there are several important factors that individuals should consider to ensure they choose the best option for their needs.

Age, Health Status, and Lifestyle Choices

Age, health status, and lifestyle choices play a significant role in determining coverage options for life and critical illness insurance. Younger individuals may have more affordable premiums, while older individuals may face higher costs due to increased risk. Health status can impact eligibility for coverage and premiums, with healthier individuals typically receiving better rates.

Lifestyle choices such as smoking, drinking, and participation in high-risk activities can also affect coverage options and premiums.

Reviewing Policy Details, Coverage Limits, and Exclusions

It is crucial to carefully review policy details, coverage limits, and exclusions before choosing life and critical illness cover. Understanding what is covered, the maximum benefit amount, and any exclusions or limitations is essential to avoid surprises later on. Make sure to compare different policies and providers to find the best fit for your individual circumstances.

Understanding Policy Terms and Conditions

When it comes to life and critical illness insurance policies, understanding the terms and conditions is crucial to ensure you have the coverage you need. Let’s break down some common terms and discuss the significance of key policy details.

Common Terms in Insurance Policies

- Sum Assured: This is the amount of money that will be paid out by the insurance company in the event of a claim.

- Premium: The amount you pay regularly to maintain your insurance coverage.

- Exclusions: Specific conditions or circumstances not covered by the policy.

Significance of Waiting Periods, Coverage Duration, and Renewal Terms

- Waiting Periods: This is the period of time after purchasing the policy during which certain benefits may not be available. It’s important to understand the waiting period for different types of coverage.

- Coverage Duration: Knowing how long your policy will remain in effect is crucial for planning and ensuring continuous coverage for yourself and your loved ones.

- Renewal Terms: Understanding the terms for renewing your policy is important to avoid any lapses in coverage. Be aware of any changes in premiums or coverage that may occur upon renewal.

Ensuring Full Understanding of Coverage

- Read the Fine Print: Take the time to carefully read through your policy documents to understand all the terms and conditions.

- Ask Questions: If you’re unsure about any aspect of your coverage, don’t hesitate to reach out to your insurance provider for clarification.

- Review Regularly: It’s important to review your policy periodically to ensure it still meets your needs and make any necessary adjustments.

Claim Process and Payouts

When it comes to claiming your life or critical illness insurance, understanding the process is crucial to ensure a smooth experience during a challenging time. Below, we will Artikel the steps involved in filing a claim, the typical documentation required, and the timelines for claim approvals and payouts in different scenarios.

Steps in Filing a Claim

- Contact your insurance provider as soon as possible to initiate the claim process.

- Fill out the necessary claim forms provided by the insurer.

- Submit any required documentation to support your claim, such as medical reports or death certificates.

- Cooperate with any investigations or inquiries conducted by the insurance company.

Documentation Required for Claim Processing

- For life insurance: death certificate, policy documents, proof of identity of the beneficiary, and any other relevant documents.

- For critical illness cover: medical reports confirming the diagnosis, policy details, and identification documents.

- Additional documentation may be requested based on the specific circumstances of the claim.

Timelines for Claim Approvals and Payouts

- Claim approvals and payouts can vary depending on the complexity of the case and the completeness of the documentation provided.

- Simple claims with all necessary documents in order may be processed relatively quickly, leading to faster payouts.

- More complex claims or those requiring further investigation may take longer to approve and process, delaying the payout to the beneficiary.

- Insurance companies typically aim to settle claims within a reasonable timeframe to provide financial support to the policyholder or their beneficiaries.

Final Summary

In conclusion, The Truth About Life and Critical Illness Cover underscores the significance of safeguarding oneself and loved ones against unforeseen circumstances. By grasping the key elements discussed, individuals can navigate the realm of insurance with confidence and clarity.

Helpful Answers

What is the difference between life insurance and critical illness cover?

Life insurance provides financial protection to beneficiaries in case of the policyholder’s death, while critical illness cover offers a lump sum payment upon diagnosis of a specified serious illness.

How do age and health status influence coverage options?

Age and health status can affect premiums and coverage limits. Younger, healthier individuals may have more options and lower premiums compared to older or less healthy individuals.

What types of illnesses are typically covered by critical illness policies?

Critical illness policies usually cover major illnesses such as heart attack, stroke, cancer, and organ transplants. It’s important to review the policy for a detailed list of covered illnesses.