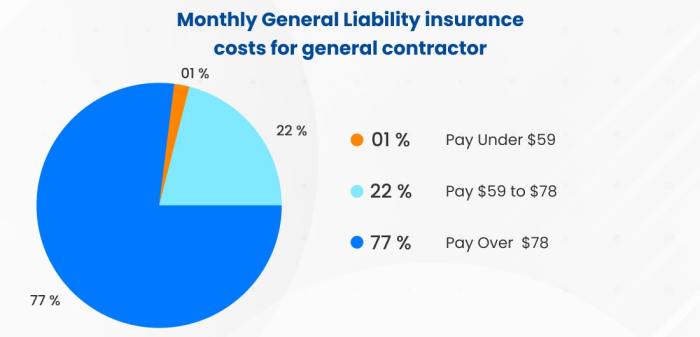

Exploring the realm of finding affordable general liability insurance for contractors, this guide offers valuable insights and practical tips to navigate the complex landscape of insurance policies. From researching different providers to understanding coverage needs, this discussion aims to equip contractors with the knowledge needed to secure cost-effective insurance solutions.

Researching General Liability Insurance

When it comes to finding cheap general liability insurance as a contractor, researching different insurance providers is crucial. This allows you to compare quotes, coverage options, and find the best policy that suits your needs and budget.

Importance of Researching Insurance Providers

- Compare quotes: Obtaining quotes from various insurance providers helps you understand the market rates and identify cost-effective options.

- Evaluate coverage options: Researching different providers allows you to compare the coverage offered in each policy and choose the one that provides adequate protection for your business.

- Check customer reviews: Reading reviews from other contractors can give you insight into the quality of service and claims process of each insurance provider.

Tips for Comparing Quotes

- Request multiple quotes: Get quotes from at least three different insurance companies to compare prices and coverage.

- Consider deductibles: Evaluate how deductibles affect the premiums and choose a balance that works for your budget.

- Review coverage limits: Make sure the policy offers sufficient coverage limits for your business operations and potential risks.

Key Factors to Consider

- Policy exclusions: Understand what is not covered by the policy to avoid surprises when filing a claim.

- Claims process: Research how easy or complicated it is to file a claim with each insurance provider to ensure a smooth experience in case of an incident.

- Financial stability: Check the financial ratings of insurance companies to ensure they can fulfill claims in case of large losses.

Understanding Coverage Needs

When it comes to general liability insurance for contractors, understanding your coverage needs is crucial to ensure adequate protection for your business. Let’s delve into the typical coverage included in a general liability insurance policy and how contractors can assess their specific coverage needs.

Typical Coverage Included

- Bodily Injury Coverage: This protects your business if someone is injured on your property or as a result of your work.

- Property Damage Coverage: Covers damage to third-party property caused by your business operations.

- Personal and Advertising Injury: Protects against claims of libel, slander, or copyright infringement.

- Medical Payments: Covers medical expenses if someone is injured on your property, regardless of fault.

Assessing Specific Coverage Needs

- Consider the nature of your business operations and the potential risks involved.

- Assess the size of your projects and the likelihood of accidents or injuries occurring.

- Consult with an insurance agent to evaluate your business activities and determine the appropriate coverage limits.

Potential Risks to Cover

- Slip and fall accidents on job sites

- Damage to client property during construction

- Advertising injuries such as copyright infringement

- Product liability for faulty materials or workmanship

Utilizing Industry Associations

Industry associations play a crucial role in helping contractors find affordable insurance options. By joining industry-specific groups, contractors gain access to a network of professionals who can provide valuable insurance referrals and recommendations. Networking within these associations can lead to cost-effective insurance solutions tailored to the specific needs of contractors.

Benefits of Joining Industry Associations

- Access to a network of professionals: Joining industry associations connects contractors with other professionals in the field who have experience with different insurance providers and policies.

- Insurance referrals: Members of industry associations often share recommendations for insurance providers who offer competitive rates and comprehensive coverage.

- Industry-specific knowledge: Being part of an industry association allows contractors to stay informed about trends, regulations, and best practices in the field, which can help in making informed decisions about insurance coverage.

Bundling Insurance Policies

When it comes to securing insurance coverage, contractors can benefit greatly from bundling their general liability insurance with other policies. This approach not only helps in cost savings but also simplifies the insurance process.

Advantages of Bundling

- Cost Savings: Bundling general liability insurance with other policies such as property insurance, workers’ compensation, or commercial auto insurance can lead to discounted rates from insurance providers. This can result in significant cost savings for contractors.

- Convenience: By bundling multiple policies together, contractors only need to deal with one insurance provider for all their coverage needs. This streamlines the process, reduces paperwork, and makes it easier to manage insurance policies.

- Comprehensive Coverage: Bundling allows contractors to customize their insurance packages to include all the necessary coverage options they require. This ensures comprehensive protection against various risks and liabilities.

Examples of Insurance Packages

Insurance providers often offer tailored insurance packages for contractors that include a combination of general liability insurance with other essential coverages. Some popular insurance packages that may offer cost savings include:

- Business Owner’s Policy (BOP): Combines general liability insurance with property insurance in a single package, offering a cost-effective solution for small businesses.

- Commercial Package Policy (CPP): Allows contractors to bundle multiple coverages such as general liability, property insurance, and business interruption insurance into one comprehensive policy.

- Contractor’s Insurance Package: Specifically designed for contractors, this package may include general liability, workers’ compensation, commercial auto, and tools and equipment coverage at a discounted rate.

Streamlining the Insurance Process

By bundling insurance policies, contractors can simplify the insurance process and ensure they have adequate coverage for their business operations. This approach eliminates the hassle of managing multiple policies from different providers and enhances efficiency in handling insurance matters.

Final Review

In conclusion, finding cheap general liability insurance as a contractor doesn’t have to be a daunting task. By leveraging research, understanding coverage requirements, utilizing industry associations, and considering policy bundling, contractors can access affordable insurance options tailored to their specific needs.

With these strategies in mind, contractors can confidently protect their businesses while saving on insurance costs.

Helpful Answers

How can contractors find the most competitive insurance rates?

Contractors can find competitive rates by comparing quotes from different insurance providers, considering bundling options, and leveraging industry associations for referrals.

What are some common risks that should be covered by general liability insurance?

Common risks include property damage, bodily injury, legal fees, and advertising injury claims.

Why is it important for contractors to assess their specific coverage needs?

Assessing coverage needs ensures that contractors have adequate protection tailored to their unique business risks.